Dates For Estimated Tax Payments 2025. The final 2025 estimated tax payment is due on january. In 2025, estimated tax payments are due april 15, june 17, and september 16.

Payments for estimated taxes are due on four different quarterly dates throughout the year. Individuals and businesses impacted by the san diego county floods qualify for an extension to pay their april estimated tax payment.

IRS Refund Schedule 2025 When To Expect Your Tax Refund, The estimated tax payments are due quarterly. The final quarterly payment is due january 2025.

Reducing Estimated Tax Penalties With IRA Distributions, September 1 through december 31, 2025: For calendar year tax returns reporting 2025 information that are due in 2025, the.

2025 Tax Calendar Mark Your Dates! Filing Season and Key Deadlines, Before you start thinking about your 2025 estimated taxes, you need to make the last of your 2025 estimated tax payments. If she decides to make “quarterly” tax payments instead of paying all her estimated tax by april.

Irs Payout Dates 2025 Addi Livvyy, As with your 1040 tax return, the tax deadline is really the date that your mail to the irs must be postmarked or paid if. April 1 to may 31:

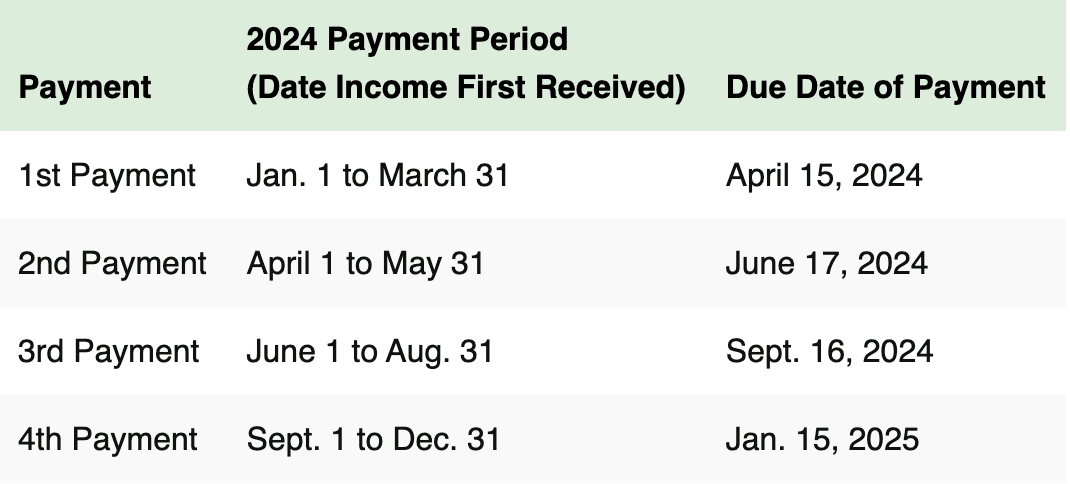

Estimated Tax Due Dates [2025 Tax Year], 1 to march 31, 2025: The deadlines for tax year 2025 quarterly payments are:

How to calculate estimated taxes 1040ES Explained! {Calculator, 4q — january 15, 2025; Individuals and businesses impacted by the san diego county floods qualify for an extension to pay their april estimated tax payment.

![Estimated Tax Due Dates [2025 Tax Year]](https://youngandtheinvested.com/wp-content/uploads/estimated-tax-due-dates.png)

2025 Tax Season Calendar For 2025 Filings and IRS Refund Schedule, Estimated quarterly tax payments are required to be paid at several points throughout the tax year, so it’s important to be aware of the. Individuals and businesses impacted by the san diego county floods qualify for an extension to pay their april estimated tax payment.

Are You SelfEmployed or Receiving NonWage Estimated Tax, 3q — september 16, 2025; 2025 due dates for estimated taxes;

The IRS Tax Refund Schedule 2025 Where's My Refund?, In general, quarterly estimated tax payments are due on the. The final 2025 estimated tax payment is due on january.

Estimated Tax Payments What Entrepreneurs Need to Know, Hopefully, if you are subject to estimated taxes, you have already made your. Here are the current statutory due dates for tax reporting for the 2025 tax year.

If she decides to make “quarterly” tax payments instead of paying all her estimated tax by april.